How One DSO Solved Patient Financing –And Boosted Financing Revenue By 5x

Darren Boggs, CEOAltius Healthcare Management

I suppose every dental organization thinks they’re special, but I can’t help but believe that the dental offices of Altius Healthcare Management are extra special. Why? Because we operate in places others don’t –the small towns of Texas that would be so easy to overlook. These rural areas are tertiary markets where local dentists don’t have the luxury of saying, “I only see adults,” or “I only accept XYZ insurance.” The population density just doesn’t support that kind of segmentation.

That’s why we see patients of every age, and we accept every form of payment and every form of insurance there is. We take government insurance, and we offer dental discount plans for patients who have no coverage at all. For us, it’s about meeting our mission of making sure all people have access to quality oral healthcare.

When you pitch as big of a tent as we do, you see a wide range of patients –from kids on CHIP or Medicaid to elders on Medicare. We also see a lot of blue-collar workers who have limited time and money to spend on dental care. These folks tend to take care of their families first and themselves second. Years of neglect can pile up before they find their way to our offices, at which point even a good dental insurance policy is not going to be much help. You have to turn to patient financing.

We see a lot of blue-collar workers who have limited time and money to spend on dental care. These folks tend to take care of their families first and themselves second. Years of neglect can pile up before they find their way to our offices, at which point even a good dental insurance policy is not going to be much help. You have to turn to patient financing.

The Results with Sunbit

Served

Experienced a

Generated an additional

240%

$2.6M

2,667

increase in patient financing approvals

in financing revenuein a little over a year

more patients who needed esential care

Patient Financing in the Big Tent

In situations like this, we used to offer traditional patient financing to help patients bridge the financial gap. But the truth is that we hated seeing so many patients being turned down –and even more patients who wouldn’t bother applying in the first place. In fact, we couldn’t crack the 25% patient approval rate with our longstanding financing solution.

That’s when I set out to find a financing option we could offer our patients that gave us the confidence they would get approved. When I set out on my search, I had no idea that I would not only find a solution to our patient financing problem, but I would also find a way to grow our monthly financing revenue by 5x. How did I do it? With a technology called Sunbit.

Unlike traditional financing solutions, Sunbit doesn’t require a hard credit check to check your options, it doesn’t involve a complicated application, and it doesn’t ask a lot of nosy questions that make everyone in the room feel awkward.

Smile Now, Pay Over Time.

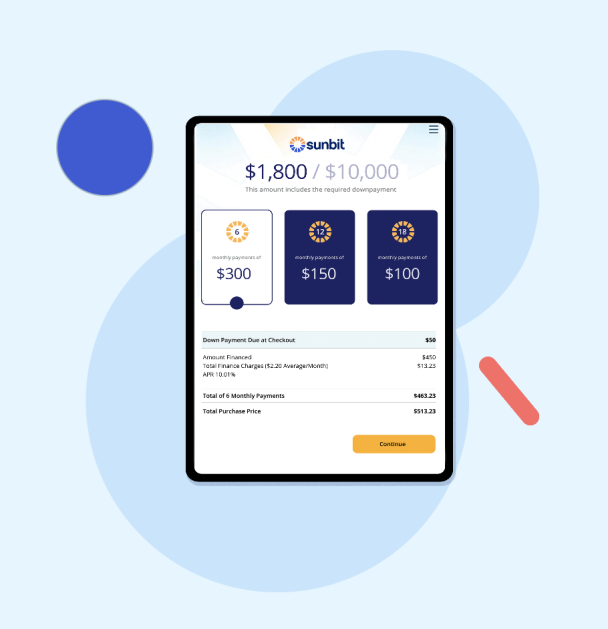

If you haven’t heard of Sunbit, let me tell you a little about it. It’s an all-digital “buy now, pay-over-time” solution. Unlike traditional financing solutions, it doesn’t require a hard credit check to check your options, it doesn’t involve a complicated application, and it doesn’t ask a lot of nosy questions that make everyone in the room feel awkward. Best of all, it gives patients an answer lightning fast.

Once approved, the patient chooses the simple interest loan that best meets their needs, all with fair, fixed rates that allow them to spread the payments over time. They put down a deposit, and treatment can begin on the spot. There are no hidden fees and no surprise balloon payments down the road. It’s all very straightforward and easy to understand.

As for our practices, they get paid right away via ACH. If for some reason the patient doesn’t follow through on their payments, the practice doesn’t have to deal with that. That’s between Sunbit and the patient. Sunbit is never going to come clawing those funds back from the practice. We are not responsible for the financing or servicing the loan, which is a relief for us. All loans are made by TAB Bank, which determines qualifications for and terms of credit.

Three Outsized Outcomes

We implemented Sunbit across 31 dental practices in September of 2021. And as they say on TV, you won’t believe what happened next. We sure didn’t. The first thing we saw was our financing approval rates go up dramatically –from an all-time high of 25% with our traditional financing solution to a consistent 85% with Sunbit.

The second thing we realized is that we didn’t need our “first-look” option anymore and could simplify our offerings. Not only was Sunbit more accessible for our patients in our big tent, it offered a faster, easier, and more pleasant experience than our traditional financing solution–for everyone involved. So why offer both?

The third thing we saw was a jump in revenue, and it didn’t take long. Our first full month offering Sunbit was September 2021, and we finished that month with 7x the financed revenue we normally had. And while those numbers were astonishing, what was even more important to us was what those numbers represented –namely, all the patients who had received care, including those who otherwise might not have.That includes patients who would normally have had to cherry-pick their treatment and put other parts of their treatment plan on hold. That is where working with Sunbit has been huge for us. We’re now able to get patients taken care of in a timely manner, before things get worse. To date, Sunbit has helped over 2,650 of our patients access such dental treatments.

New Opportunities on the Horizon

Now that we have Sunbit in place, there are a handful of new opportunities on the horizon for Altius Healthcare Management and our patients. For starters, we’ve added a partnership with an aligner company for 2022, so we can provide our underserved communities with state-of-the-art invisible aligner treatment. We’re also looking at offering implants at more locations –something we see a great need for. Because we have Sunbit as a partner, we have a lot more confidence about making the investment to bring these and other more advanced treatment options into the office, and we’re confident we have the financing solution in place to make them successful.

Final Thoughts

There are some dentists who are not comfortable with “buy now, pay-over-time” solutions –or with patient financing in general. Maybe they haven’t had a financing partner that truly felt like a “partner.” I know this was the case for us. To these folks, I would just ask, “How important is it that the patient gets the work done? How long can it wait?” For us, Sunbit has been the partner we’ve always wanted. They have opened the door for a whole lot of people that need care and didn’t have any other way to finance it. They’re finally able to get the work they need to get done, in a fair and transparent way, and for me, that’s what dentistry is about.

“How important is it that the patient gets the work done? How long can it wait?” For us, Sunbit has been the partner we’ve always wanted. They have opened the door for a whole lot of people that need care and didn’t have any other way to finance it.

Ready to learn more about our patient financing solution?

See why Sunbit technology is offered by over 20,000 merchants.

*Subject to approval based on creditworthiness. Payment due at checkout. Example: A $1,178.00 purchase with 24.99% APR, $199.55 down payment and a 18-month term would have monthly payments of $65.74 and a total cost of $1,382.84. Terms may vary. 0% APR plans for well-qualified customers are available at participating merchants only. State restrictions may affect eligibility for the plan. 6- to 72- month plans available depending on creditworthiness and other factors, including merchant participation; $3,000 minimum purchase price also required at certain merchants. Not available in VT, WV, or WY. Account openings and payment activities are reported to a major credit bureau. See Rules and Terms for loan requirements and state restrictions. Sunbit Now, LLC is licensed under the CT Laws Relating to Small Loans (lic. #SLC-1760582 & SLC-BCH-1844702); NMLS ID 1760582. Loans are made by Transportation Alliance Bank, Inc., dba TAB Bank, which determines qualifications for and terms of credit.