A Survey of Dental Professionals

Case Acceptance Matters:

How Dental Professionals are Overcoming CostBarriers

Nearly 40% of Americans can’t cover a surprise $400 expense, so how can we expect patients to be able to afford their dental treatments?

You enter the exam room. Your patient is anxiously waiting to hear your assessment. As you start explaining their exam results and recommended treatment, you notice a sudden look of fear in their eyes. Not because you’re recommending a crown, root canal, or implant. It’s something else altogether. You pause, and they start firing questions at you. “Does my insurance cover this?” “How much is this going to cost?!” “Give it to me straight.” It’s begun. Foreboding sticker shock has clouded your patient’s greater judgment. Although their health and treatment should be the focus, they are overwhelmed with dread over the impending dent in their wallet.

This scenario occurs across thousands of practices every day. Unfortunately, a lot of patients either go forward with partial treatment or refuse treatment altogether. Sure, there are financing options, but we all know that half of the people who apply get rejected. This is not sustainable.

Care vs. Cost

59%

According to the ADA, 59% of adults indicate they’ve forgone dental care due to cost ¹. This makes sense, considering that 63% of patients pay at least a portion of their dental treatments out-of-pocket ², and the average annual per-patient cost is $685³. Yet, nearly 40% of Americans can’t cover a surprise $400 expense so how can we expect patients to be able to afford their dental treatments?

It doesn’t add up. These out-of-pocket costs can be demoralizing for patients. The cost of care is often unexpected and has not been factored into monthly budgets.

adults have forgone dental care due to cost.

4

Low Case Acceptance Is A "Thing"

Based on survey responses from thousands of dental practices, the average case acceptance rate for established patients is between 50%-60%, and for new patients, 25%-35%. Dentists face an uphill battle in providing comprehensive dental care. The fact is, cost is the deciding factor in patients’ ability to undergo treatment, resulting in lower treatment acceptance rates, dissatisfaction, and less healthy patients. However, a new survey also shows huge potential to close the gap, treat more patients, and increase production.

5

Making Treatment Accessible

If cost is the number one reason patients are declining treatment, alleviating cost concerns is the answer. This doesn’t mean free treatments, or anything that will hurt the dental practice.

One of the primary vehicles for making dental treatment attainable is offering access to fair patient financing for all patients—without the practice becoming the lender.

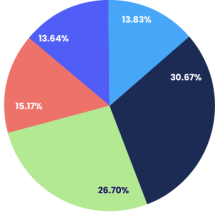

While we know financing can help patients access their needed dental care, why aren’t dental professionals offering financing options proactively? To better understand the relationship between patients, dental professionals, and financing tools, we surveyed 1,559 dental professionals to get some answers. According to the survey, 58% said they aren’t proactively offering financing as a payment option. This is surprising. As a result, more patients deny treatment, leading to lower case acceptance rates.

6

Frequency of Offering Financing to Patients

How often are you offering financing to patients?

Only when patient asks

If patient treatment is not fully covered by insurance

To every patient

Depends on the treatment price

We never offer financing

When asked why they’re not offering financing to patients, the most common reason was they thought their patients don’t need it (32%). However, the perception that patients don’t need financing does not align with reality—the data shows that patients need and want more options to pay. If dental teams can change their perception and offer financing options to every patient, they’ll likely see higher case acceptance. However, the solution is not that simple.

Traditional Financing is Flawed

12%

Only

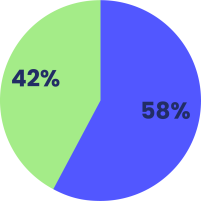

While financing offers many benefits to both the patient and the practice, there is dissatisfaction with traditional financing options. In fact, only 12% of dental professionals are completely satisfied with their existing financing solutions. This dissatisfaction is likely contributing to the lower use of such tools among the dental community.

of professionals are completely satisfied with their existing financing solutions.

Level of Satisfaction Around Existing Financing Solutions

Completely dissatisfied, dissatisfied, or only somewhat satisfied

Mostly satisfied or completely satisfied

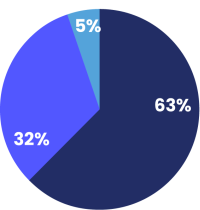

When asked why they are not offering financing to every patient, 63% of dental professionals expressed concerns related to their experience with, or perceptions around, financing.

- 17% were afraid of fees, penalties, or balloon payment traps.

- 11% said they were afraid because their patients were previously declined.

- 14% said the application was too long.

- 7% said they didn’t think their patients would be approved.

- 5% were afraid of it harming the patient’s credit score.

- 9% didn’t trust banks.

Further compounding the problem with traditional financing is the fact that many patients are declined. Nearly one-third of offices have patient financing approval rates below 59%, and over two-thirds of offices see patient approval rates below 69%. When a patient is declined, it can be disheartening for the staff and embarrassing for the patient, leaving a bad impression on both parties. The team may feel less inclined to offer financing in the future, and the patient is left without an option, often forgoing treatment.

Nearly one-third of offices have patient financing approval rates below 59%, and over two-thirds of offices see patient approval rates below 69%.

A New Era: Smile Now, Pay-over-time as a Payment Option

Smile Now, Pay-over-time allows patients to pay-over-time, with no fees,

no penalties, and often no interest. Unlike traditional financing, the approval process takes 30-seconds with almost no data entry, and most people get approved.

It’s clear that dentists continue to struggle with case acceptance regardless of the financing solution they offer, suggesting the need for a more transparent, fair, simple, and inclusive option. This is not exclusive to dental care. The disruptive financial technology called Buy Now, Pay Later is driving the growth of popular brands like Peloton, Casper, Expedia, and Apple, making their products and services more accessible to more people.

Smile Now, Pay-over-time is a buy now, pay later solution built for dental practices.* It allows patients to pay-over-time, with no fees, no penalties, and often no interest. Unlike traditional financing, the approval process takes 30-seconds with almost no data entry, and most people get approved. There is also no hard credit check. Moreover, dental practices don’t become the lender. They get paid in full within one business day. Patients also get access to the dental treatments they need urgently while selecting a payment plan that suits their budget. Unlike a medical credit card or other traditional financing methods, this solution offers patients access to simple interest loans with fixed interest rates (including some true 0% interest plans) and no late fees or penalties.

We asked dental professionals if they would be interested in offering a Buy Now, Pay Later solution to their payments. Over 63% are open to BNPL, with nearly 26% definitely interested or interested in learning more.

Openness to Offering a Buy Now, Pay Later Solution

Open to, interested or definitely interested in learning more.

No, this does not interest me.

I would never offer financing.

The Buy Now, Pay Later trend is also growing in popularity among consumers, and dental patients are starting to take note. Nearly 23% of dental patients have purchased something with a Buy Now, Pay Later payment option before. When asked if they would prefer to pay for dental treatments with Buy Now, Pay Later, over 56% of patients said they would. More so, 43% of patients said they would undergo more dental treatments if given the option to pay-over-time. It’s evident that Smile Now, Pay-over-time would be received warmly by patients if provided this payment option.

2

Over 85% of Patients are Approved for Financing Using Sunbit Technology

A Buy Now, Pay Later solution that recently became available to dental practices is Sunbit. Unlike traditional financing options, over 85% of patients are approved using Sunbit technology, allowing dental staff to confidently offer every patient the option to split their bill over time.

Dental practices adopting Sunbit are experiencing success. Jennifer Dossett, Director of Operations at Dossett Dental, is seeing the positive impact of switching from traditional financing to Sunbit’s Buy Now, Pay-over-time solution:

“For the past 15 years, we used the leading patient financing solution but became frustrated with the very low approval rates. Our front office simply stopped offering it because 60-65% of patients were declined. We want to make sure our patients have the best financing option so they can easily fulfill their treatment plan. With Sunbit, our patient approval rate is nothing short of amazing. Because 92% of our patients were approved, our group generated $104,000 in incremental production in the first month! We are using Sunbit 20X more than our prior solution.”

Conclusion

The fear of paying for dental care should never get in the way of someone getting the treatment they need.

If the goal is to help more patients fulfill their treatment plans while optimizing patient satisfaction, dental practices must evaluate the financing solutions they offer. With cost being the most apparent barrier to success, dental professionals need to consider newer innovative patient financing tools that help more patients get the dental treatments they need through a frictionless and less cumbersome process.

Buy Now, Pay Later solutions such as Sunbit are growing in popularity because of their inclusivity and ease of use. Dental professionals should take note and consider adopting this payment option.

The Smile Now, Pay-over-time technology built for dental.

We approve over 85% of patients

who apply to get their dental care today and pay-over-time.

*Loans are made by Transportation Alliance Bank, Inc., dba TAB Bank, which determines qualifications for and terms of credit.

Resources:

1. https://www.ada.org/en/science-research/health-policy-institute/dental-statistics/patients

2. Patient Survey: n=500 U.S. adults age 18 or older nationwide. July 29 - August 12, 2021.

3. http://www.ada.org/~/media/ADA/Science%20and%20Research/HPI/Files/HPIBrief_0316_4.pdf

4. https://www.cbsnews.com/news/nearly-40-of-americans-cant-cover-a-surprise-400-expense/

5. https://www.dentaleconomics.com/practice/article/16390062/case-acceptance-the-key-to-growth

6. Dental Professionals Survey: n=1,559 U.S. adults age 18 or older nationwide. May 5 - June 27, 2021.